A business budget is more than a spreadsheet—it’s your financial GPS. It helps you anticipate cash flow, avoid overspending, and invest wisely in growth. Whether you’re launching a startup or running a small business, a well-built budget turns uncertainty into strategy. Here’s how to create one in 4 clear steps (read time: 3–4 minutes).

1. Estimate Your Revenue Realistically

Start with income—not expenses. Review past sales data if available, or research industry benchmarks if you’re new. Break revenue down by:

- Sales channels (online, in-person, wholesale)

- Product or service lines

- Seasonal trends

Be conservative. It’s better to under-promise and over-deliver than to base decisions on optimistic projections.

2. Categorize and List All Expenses

Divide costs into two buckets:

Fixed Costs (same every month):

- Rent

- Software subscriptions

- Insurance

- Salaries

Variable Costs (change with sales volume):

- Raw materials

- Shipping

- Marketing ads

- Payment processing fees

Don’t forget one-time or annual expenses (e.g., website renewal, licenses)—divide them into monthly amounts.

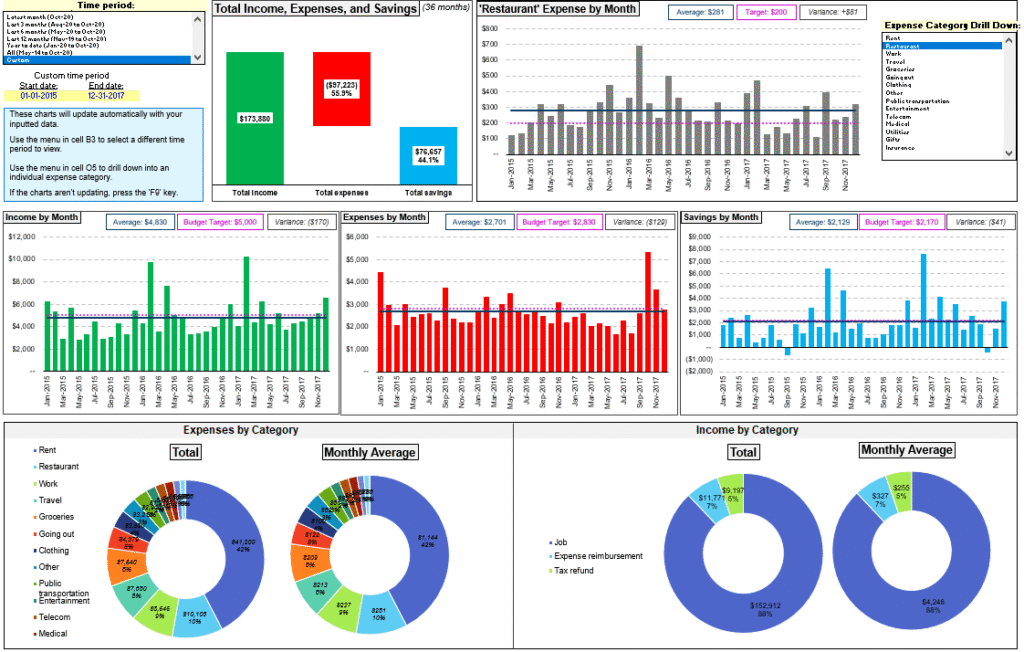

3. Build Your Budget Template

Use a free tool like Google Sheets, Excel, or a budgeting app (Wave, Zoho Books). Your template should include:

- Monthly columns (12 months)

- Rows for each income and expense category

- Formulas to auto-calculate totals, net profit (Revenue – Expenses), and cash flow

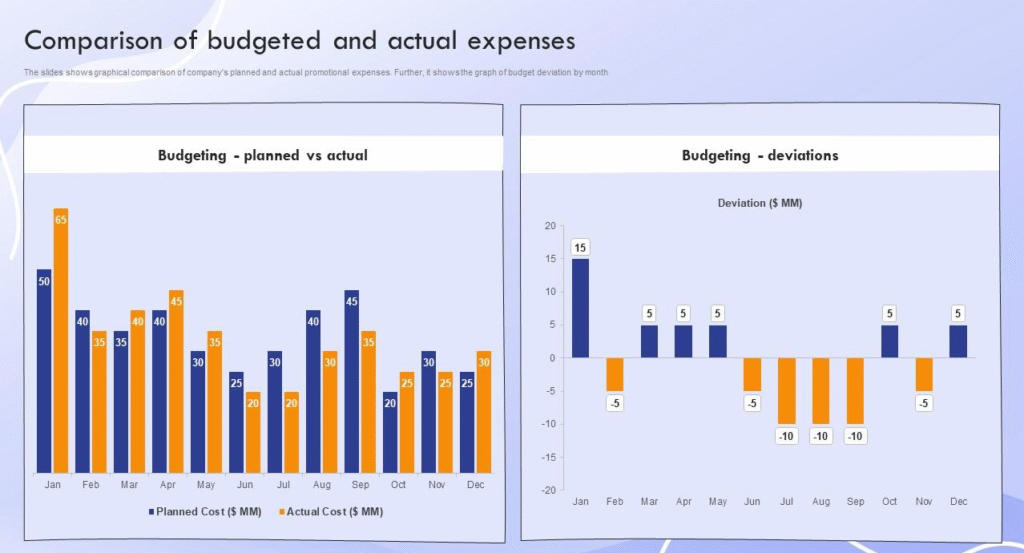

4. Monitor, Compare, and Adjust

Your budget isn’t set in stone. At the end of each month:

- Compare actual income/expenses to your budget

- Identify variances (e.g., “Marketing spend was 30% over—why?”)

- Adjust next month’s forecast based on real data

This “rolling forecast” approach keeps your business agile and financially aware.

Pro Tips

- Always include a contingency fund (5–10% of total expenses) for surprises.

- Separate business and personal finances—it’s essential for accurate budgeting.

- Review quarterly with your team or accountant to align on goals.

FAQs

Q: How detailed should my budget be?

A: Detailed enough to spot problems early—but not so granular it becomes overwhelming. Group similar items (e.g., “Office Supplies” instead of listing every pen).

Q: What if I have no past data to base my budget on?

A: Use industry averages, competitor research, and pilot testing. Start with a 3-month “test budget,” then refine based on real results.

Q: Should I budget for profit?

A: Yes! Treat profit as a non-negotiable line item (e.g., aim for 10–20% net margin). Pay yourself and reinvest in the business consistently.