A business line of credit is like a financial safety net—and a growth accelerator. Unlike a loan (where you get a lump sum), a line of credit lets you borrow up to a set limit, repay, and borrow again as needed. It’s ideal for managing seasonal dips, unexpected costs, or timely opportunities. But lenders don’t just hand these out—you need to build trust first. Here’s how to qualify and use one wisely (read time: 3–4 minutes).

1. Establish a Solid Business Foundation

Lenders want to see your business is real, legal, and operational:

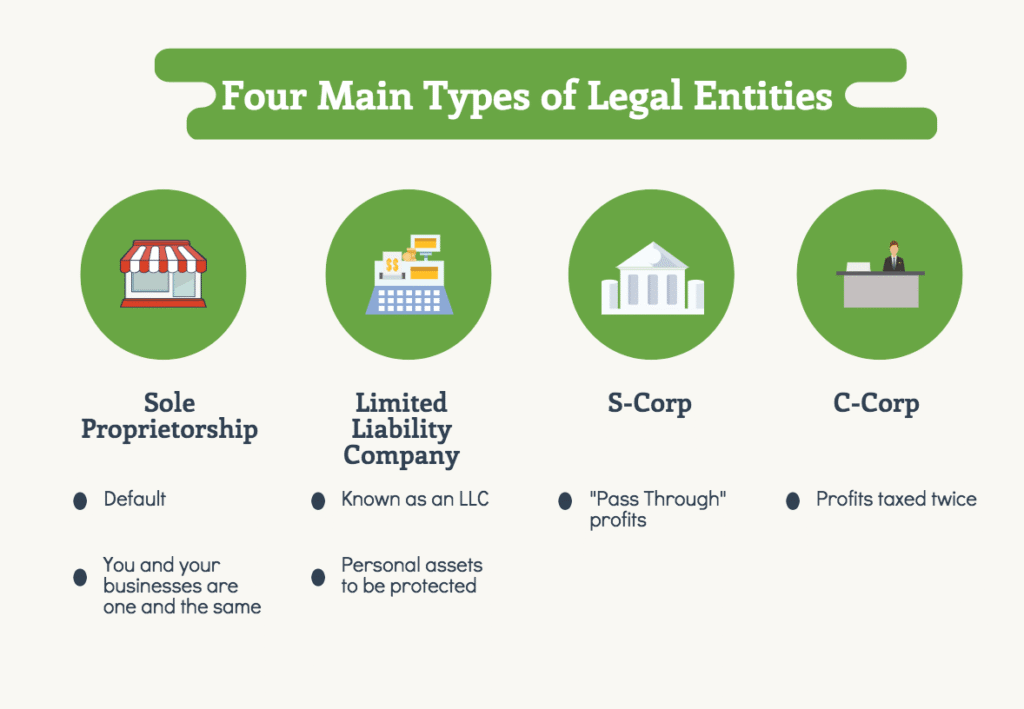

- Form a legal entity (LLC or corporation preferred)

- Get an EIN from the IRS (free at irs.gov)

- Open a dedicated business bank account

- Register with Dun & Bradstreet to get a D-U-N-S Number (free at dnb.com)

These steps prove you’re serious—and separate your business finances from personal ones.

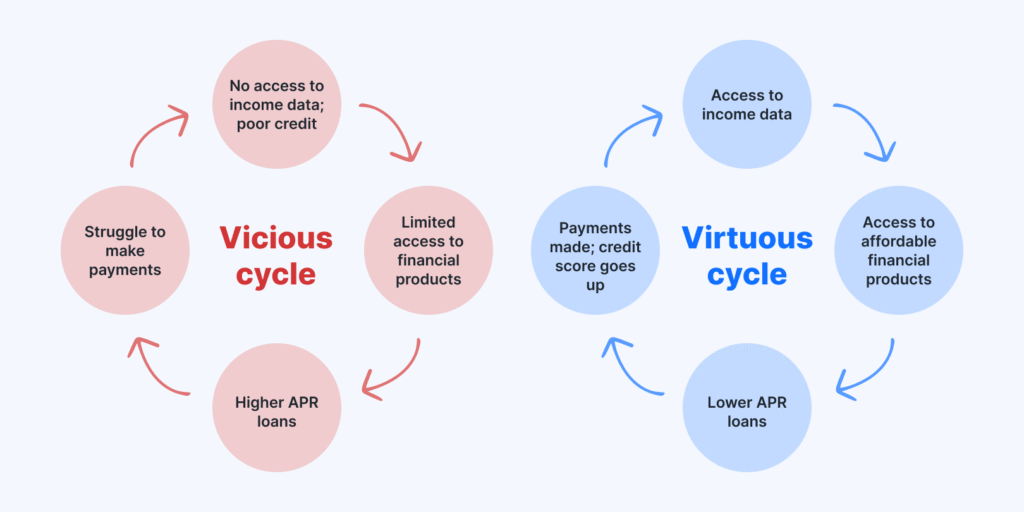

2. Build Business Credit History

Most traditional lenders require 6–24 months of business credit history. Start by:

- Opening net-30 accounts with vendors like Uline, Grainger, or Dell that report to business credit bureaus (Dun & Bradstreet, Experian, Equifax)

- Paying invoices on time or early

- Keeping credit utilization below 30%

Check your D&B PAYDEX score (aim for 75–100) and Experian Intelliscore regularly.

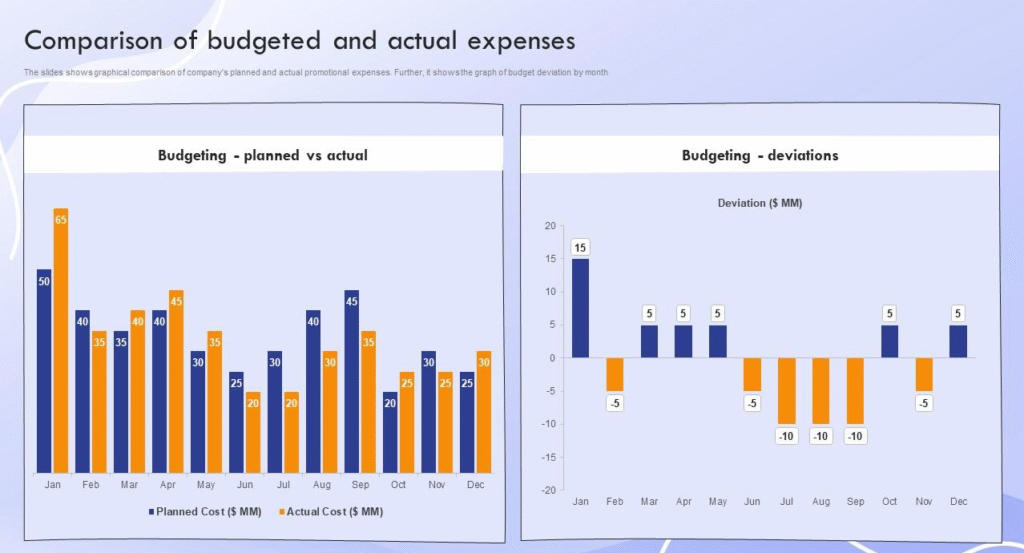

3. Maintain Healthy Cash Flow and Revenue

Lenders look for:

- Minimum monthly revenue ($5,000–$10,000+ depending on lender)

- Consistent deposits in your business bank account

- Low debt-to-income ratio

Even if profits are modest, steady cash flow shows you can repay what you borrow.

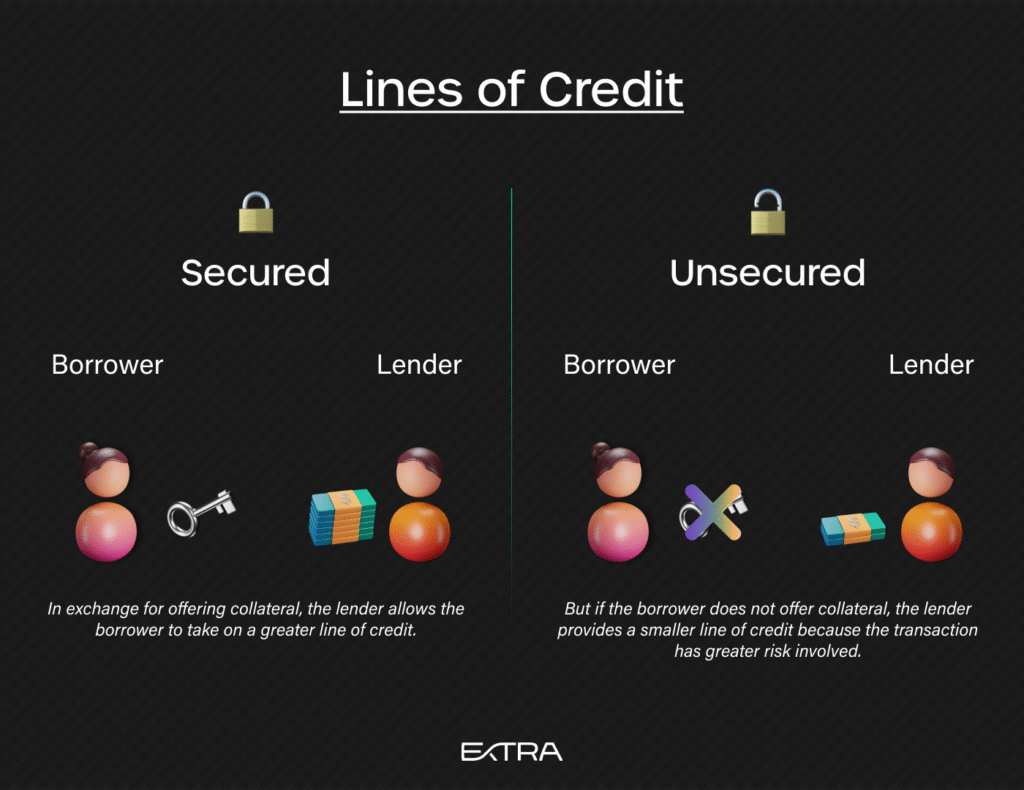

4. Choose the Right Type of Line of Credit

- Traditional bank/SBA lines: Lower rates, but require strong credit and 2+ years in business.

- Online lenders (e.g., Fundbox, BlueVine, Kabbage): Faster approval, accept 6+ months in business, but higher rates.

- Secured lines: Backed by assets (e.g., inventory, equipment)—easier to qualify for.

Start with online lenders if you’re under 2 years old; graduate to banks as you grow.

5. Use It Responsibly to Build Trust

- Borrow only what you need

- Repay on time—every time

- Avoid maxing out your limit

- Use it for business purposes only (e.g., payroll, inventory, marketing—not personal expenses)

Responsible use boosts your credit profile and may lead to higher limits or better terms.

Final Tip

A business line of credit is a tool—not a solution. Pair it with solid budgeting and cash flow planning to avoid debt traps.

FAQs

Q: Can I get a business line of credit with bad personal credit?

A: It’s harder, but possible. Some online lenders focus more on business revenue than personal credit. Aim for a personal FICO score of at least 600–650 for better options.

Q: How much can I borrow?

A: Limits range from $1,000 to $250,000+. New businesses typically qualify for $5,000–$50,000; established businesses with strong cash flow may access six figures.

Q: Does applying hurt my credit?

A: Most lenders perform a “soft pull” initially (no impact). A “hard pull” happens only if you accept the offer—so shop around within a short window to minimize credit score impact.