You don’t need to wait until college to become an entrepreneur. In fact, starting a business as a teenager gives you real-world skills, financial independence, and a major edge on your resume. From lawn care to digital design, teens are building six-figure businesses before graduation. Here’s how to start yours—safely, legally, and successfully (read time: 3–4 minutes).

1. Pick a Business That Fits Your Life

Choose something that:

- Uses your current skills or interests (gaming, art, sports, tech, organizing)

- Requires little upfront money

- Works around school, sports, and family time

Top teen-friendly ideas:

- Social media management for local businesses

- Custom T-shirt or sticker design (use print-on-demand)

- Tutoring or homework help (in-person or online)

- Pet sitting, dog walking, or plant care

- Reselling thrifted or clearance items online

2. Get Parental Support (and Legal Setup)

Since you’re under 18, you’ll need a parent or guardian to:

- Help open a business bank account (most banks require an adult co-signer)

- Sign contracts or vendor agreements

- Assist with tax filing

You likely don’t need an LLC yet—but if you’re earning consistent income ($1,000+/month), talk to your parents about registering a sole proprietorship under a “Doing Business As” (DBA) name.

3. Start for Free (or Almost Free)

Use free tools to keep costs near $0:

- Website: Carrd.co or Canva Websites (free plans available)

- Logo & graphics: Canva

- Invoicing & payments: PayPal, Venmo Business, or Cash App

- Promotion: Word-of-mouth, school bulletin boards, local Facebook Groups

Avoid spending money until you’ve made your first sale.

4. Find Your First Customers—Fast

You don’t need thousands of followers. Start hyper-local:

- Tell friends, family, neighbors, and teachers what you offer

- Post in community groups: “Offering dog walking this summer—$15/hour!”

- Partner with a local business (e.g., design flyers for a café in exchange for exposure)

Your goal: 5 paying customers. Their feedback (and referrals) will fuel your growth.

5. Track Money and Stay Responsible

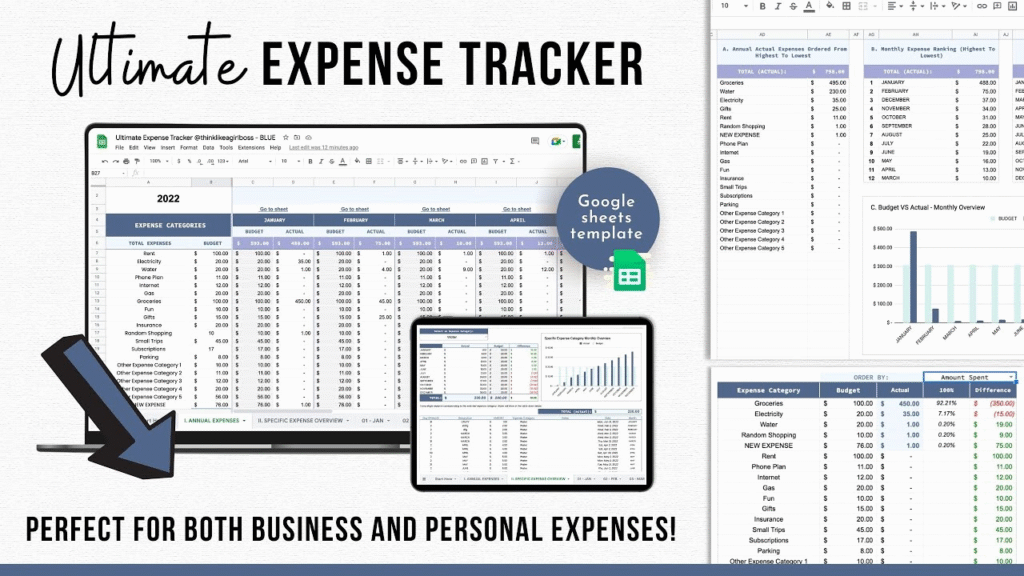

- Separate your earnings: Use a dedicated bank account or digital wallet

- Save for taxes: Set aside 15–25% of income (teens still owe self-employment tax)

- Keep it simple: Use a free app like Google Sheets to track income/expenses

Bonus: This builds financial literacy most adults never learn!

Final Tip

Your biggest advantage? Time, energy, and low overhead. You don’t need perfection—just action. One client leads to two, two to five, and soon you’re running a real business.

FAQs

Q: Do I need a business license as a teen?

A: It depends on your city and service. Many small, home-based teen businesses (like tutoring or dog walking) don’t require one—but check your local rules with a parent.

Q: Can I sell online if I’m under 18?

A: Yes—but most platforms (Etsy, Shopify) require a parent to co-sign or manage the account. Always involve a trusted adult.

Q: Will this affect my school or college apps?

A: Absolutely—in a great way! Colleges and employers love entrepreneurial initiative. Document your journey (revenue, challenges, lessons) for your resume or portfolio.