The most valuable businesses aren’t just profitable—they’re designed to run without the founder. Whether you’re planning to sell in 2 years or 10, building a “buyable” business from day one dramatically increases your exit potential. Acquirers—from private equity firms to strategic buyers—look for specific, repeatable qualities. Here’s how to bake them into your company (read time: 3–4 minutes).

1. Reduce Owner Dependency (The #1 Dealbreaker)

If your business collapses when you take a vacation, no one will buy it. Build systems, not sweat:

- Document every key process (sales, onboarding, fulfillment) in a shared drive or tool like Notion

- Hire or train others to handle core functions (even part-time)

- Avoid being the sole point of contact for clients or vendors

💡 Acquirers ask: “Can this run smoothly for 90 days if the founder disappears?”

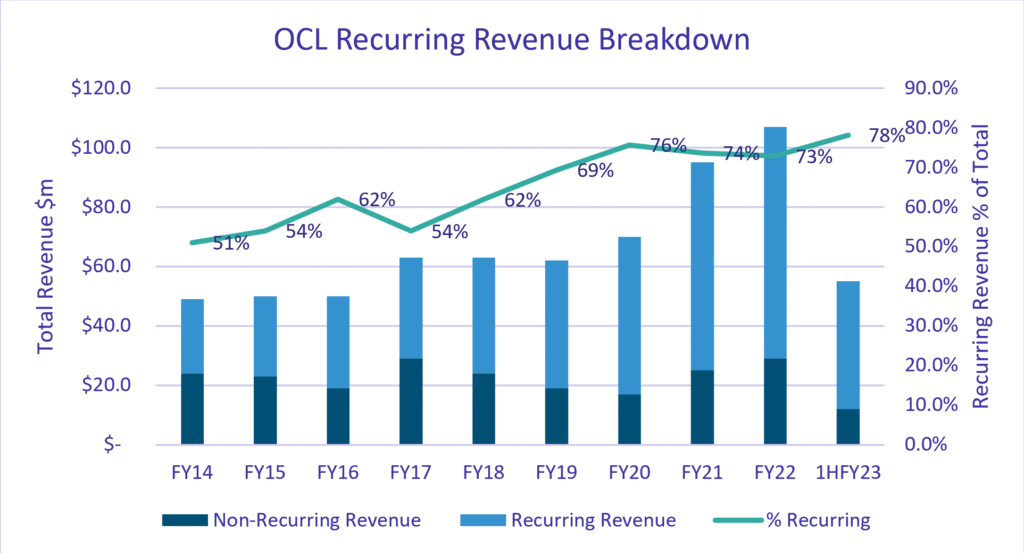

2. Build Recurring, Predictable Revenue

One-off sales are risky. Buyers pay premiums for reliability:

- Offer subscriptions, retainers, or service contracts

- Diversify clients (no single customer >10–15% of revenue)

- Secure multi-year agreements where possible

Example: A marketing agency with 30 clients on $2,000/month retainers is far more valuable than one with 5 project-based clients.

3. Maintain Clean Financials and Healthy Margins

From Day 1:

- Use accounting software (QuickBooks, Xero)

- Separate personal and business finances

- Track key metrics: EBITDA margin (aim for 20%+), customer acquisition cost (CAC), and lifetime value (LTV)

Buyers analyze 3+ years of financials—make yours audit-ready, accurate, and growing.

4. Protect and Package Your Assets

Your business value lives in intangible assets:

- Intellectual property: Trademark your name/logo; document proprietary methods

- Digital assets: Own your domain, email list, social handles, and content

- Team: Cross-train key staff; reduce reliance on “irreplaceable” employees

- Reputation: Maintain 4.8+ star reviews and strong online presence

These often drive 70%+ of your sale price.

5. Know Your Buyer Profile Early

Different buyers want different things:

- Strategic buyers (competitors, partners): Pay more for synergies (e.g., your customer list)

- Financial buyers (private equity): Want strong cash flow and growth potential

- Micro-acquirers (founders, SMBs): Look for businesses earning $50K–$500K/year profit

Design your business with your ideal buyer in mind.

Final Tip

Think like an owner, build like a seller. Every decision—hiring, pricing, tech stack—should answer: “Does this make my business easier to run, more profitable, and more attractive to acquire?”

FAQs

Q: How early should I start preparing to sell?

A: Ideally, from the beginning. But if you’re already operating, start now—most buyers want 2–3 years of consistent, documented performance.

Q: What’s the biggest mistake founders make when building to sell?

A: Waiting until they’re “ready to exit” to fix dependencies. By then, it’s too late. Build transferability into your DNA early.

Q: Do I need millions in revenue to attract buyers?

A: No. The “micro-acquisition” market is booming. Businesses with $50K–$500K in annual profit (especially SaaS, e-commerce, digital services) sell regularly on platforms like MicroAcquire, Quiet Light, and Empire Flippers.