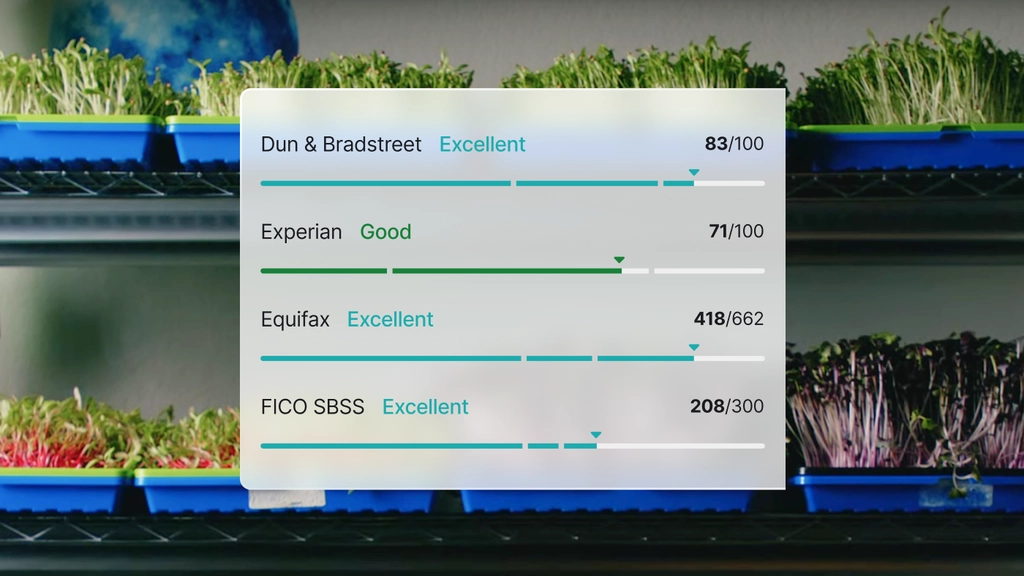

Your business credit rating is your company’s financial fingerprint. It determines whether you qualify for loans, vendor terms, equipment financing, and favorable interest rates—all while keeping your personal assets protected. Unlike personal credit (tracked by FICO), business credit is monitored by bureaus like Dun & Bradstreet (D&B), Experian Business, and Equifax Business, and rated using scores like PAYDEX, Intelliscore Plus, and Business Credit Risk Score.

The best part? You can build a strong business credit rating from scratch—even with no revenue, no bank account, or limited personal credit. Here’s how to do it right.

1. Legally Establish Your Business Entity

Start with an LLC or corporation—not a sole proprietorship. This creates a legal separation between you and your business, which is essential for true business credit. Once formed, obtain an Employer Identification Number (EIN) from the IRS (free at irs.gov ). Never use your Social Security number for business accounts.

✅ Pro Tip: Register your business with your state and secure a dedicated business phone number and address (a P.O. Box or virtual office works).

2. Get a D-U-N-S® Number from Dun & Bradstreet

Dun & Bradstreet is the most widely used business credit bureau by lenders and suppliers. Request your free D-U-N-S Number at dnb.com . This unique identifier links your business to its credit profile. Processing typically takes 24–72 hours.

Ensure your business name, address, and phone number (NAP) are consistent across your website, Google Business Profile, and all official documents—this boosts credibility and reporting accuracy.

3. Open Reporting “Net 30” Vendor Accounts

These are starter credit accounts where you buy supplies now and pay in 30 days. Crucially, choose vendors that report payment activity to business credit bureaus. Top fast-reporting options include:

- Uline (packaging & shipping supplies)

- Grainger (industrial & safety equipment)

- Crown Office Supplies

- Summa Office Supplies

- Nav’s Verified Vendors

Apply using your EIN—not your SSN. Make small purchases and pay early (e.g., within 10–15 days). This helps you achieve a PAYDEX score of 80+ (D&B’s ideal benchmark for on-time payment reliability).

4. Add a Business Credit Card That Reports to Bureaus

Not all business credit cards report to business credit agencies—so verify before applying. Strong options include:

- Brex (reports to D&B and Experian; no personal guarantee for qualifying businesses)

- Divvy (reports to D&B)

- Ramp (reports to D&B)

Use the card for recurring, predictable expenses (like software subscriptions or domain renewals) and pay the balance in full before the statement closes to maintain low credit utilization (<10% ideal).

5. Monitor, Verify, and Grow Your Rating

Check your business credit reports quarterly:

- Dun & Bradstreet: businesscredit.dnb.com

- Experian Business: experian.com/business

- Equifax Business: equifax.com/business

Dispute inaccuracies immediately. Avoid opening too many accounts at once. After 3–5 on-time tradelines report for 60+ days, your business credit rating will rise significantly—making you eligible for unsecured business loans and better terms.

FAQs

Q: How long does it take to build a business credit rating?

A: You can establish a basic profile in 30 days. A strong, fundable rating (e.g., PAYDEX 80+) typically takes 60–90 days of consistent, early payments.

Q: Can I build business credit with no revenue or personal credit?

A: Yes. Many Net 30 vendors and modern fintech cards (like Brex) approve based on your EIN, business bank account, and cash flow—not personal credit.

Q: Will lenders still check my personal credit?

A: Initially, some may—but once you have 2–3 verified tradelines reporting on time, many vendors and lenders rely solely on your business credit rating.