Canada is one of the world’s most entrepreneur-friendly countries—with strong support programs, low corruption, and access to global markets. Whether you’re a newcomer, student, or seasoned professional, building a business here follows a clear path. This guide walks you through the essential steps to start your Canadian business the right way (read time: 3–4 minutes).

1. Choose Your Business Structure

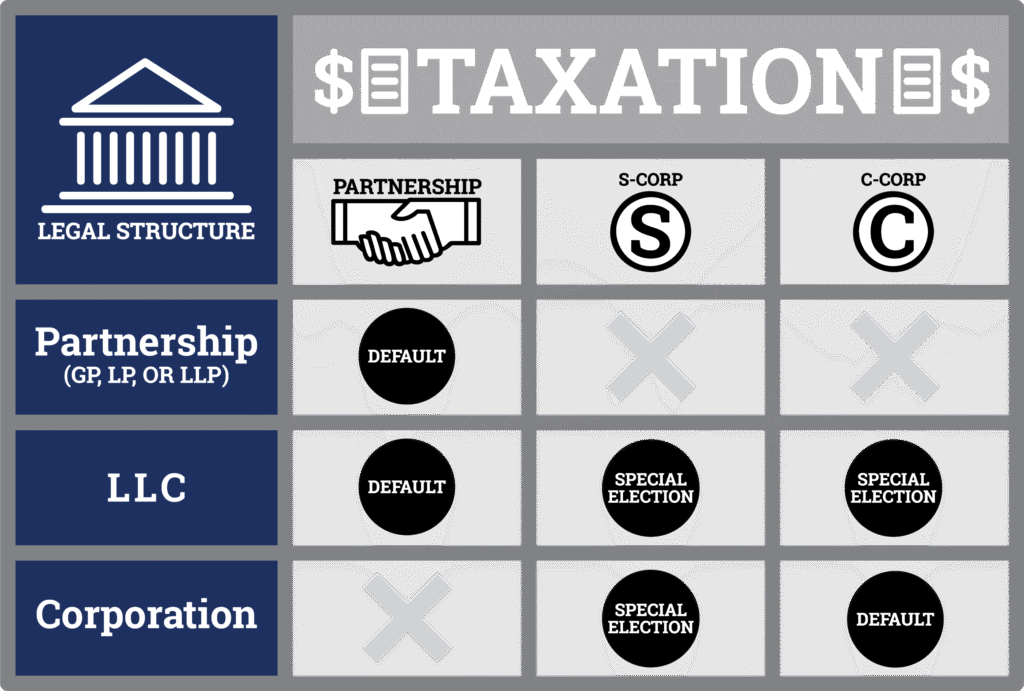

Your legal structure affects taxes, liability, and paperwork. Common options:

- Sole Proprietorship: Simplest (you = the business). No registration needed if using your legal name.

- Partnership: For 2+ owners. Draft a partnership agreement.

- Corporation (Incorporated): Recommended for serious ventures. Offers liability protection and tax advantages. Can be federal or provincial.

💡 Tip: Most small businesses start as sole props, then incorporate once revenue hits $50K–$100K/year.

2. Register Your Business Name

- If using your legal name, no registration needed for sole props.

- If using a trade name (e.g., “Maple Tech Solutions”), register it:

- Provincially: Through your province’s registry (e.g., ServiceOntario, BC Registry)

- Federally: Via Corporations Canada (for nationwide protection)

Registration costs $60–$100 and takes minutes online.

3. Get Your Business Number (BN) and Accounts

Apply for a Business Number (BN) from the Canada Revenue Agency (CRA)—it’s free and takes 5 minutes online. This 9-digit number unlocks key accounts:

- GST/HST Account: Required if revenue > $30,000/year (voluntary below that)

- Payroll Account: If you hire employees

- Import/Export Accounts: If trading internationally

Apply at cra-arc.gc.ca/bn

4. Open a Business Bank Account

Separate your finances from day one. Canadian banks (RBC, TD, BMO, etc.) offer free or low-cost accounts for startups. You’ll need:

- Business registration documents

- Government-issued ID

- Business Number (BN)

Many banks also offer entrepreneur advisors and small business credit cards.

5. Understand Taxes and Compliance

- File annual returns: Sole props report income on your personal tax return (T1). Corporations file a T2.

- Charge and remit GST/HST: If registered, collect it on sales and file returns quarterly, monthly, or annually.

- Keep records: Save receipts, invoices, and bank statements for 6 years.

Use free tools like Wave Apps (Canadian-friendly) or hire a small business accountant (~$50–$100/hr).

Bonus: Tap Into Canadian Support Programs

Canada offers incredible resources:

- Canada Business Network: Free guides and advisors (canadabusiness.ca)

- Futurpreneur Canada: Loans + mentorship for entrepreneurs 18–39

- BDC (Business Development Bank of Canada): Startup loans, advisory services

- SR&ED Tax Credits: Up to 35% refund on R&D expenses (great for tech)

Final Tip

Start small, stay compliant, and leverage Canada’s support ecosystem. Your business doesn’t need to be perfect—it just needs to begin.

FAQs

Q: Do I need to be a Canadian citizen to start a business?

A: No! Permanent residents, work permit holders, and even some visa holders can start businesses. However, incorporation may require a Canadian director (varies by province).

Q: How much does it cost to start a business in Canada?

A: As little as $0 for a sole proprietorship using your legal name. Incorporation costs $200–$350 (federal or provincial). Add $50–$100 for business name registration and bank setup.

Q: Can I run a business from home?

A: Yes—most provinces allow home-based businesses, but check municipal bylaws (e.g., zoning, signage, client visits). Some cities require a home occupation permit (~$50–$100).