Warren Buffett doesn’t chase trends, hype, or “disruptive” tech for its own sake. He looks for simple, understandable businesses that generate reliable profits year after year—businesses with a “moat” that keeps competitors at bay. The good news? You don’t need to run Coca-Cola or Apple to apply his philosophy. Whether you’re launching a local service or a scalable brand, here’s how to build a business Buffett would admire (read time: 3–4 minutes).

1. Start with a Simple, Understandable Business Model

Buffett famously avoids businesses he can’t explain in two minutes. Ask:

- Could a smart 12-year-old understand what we do?

- Do we solve a clear, recurring problem?

- Is our revenue model obvious? (e.g., subscription, product sales, service fees)

Avoid overcomplication. A plumbing company, a niche SaaS tool, or a regional bakery can all be “Buffett-worthy” if they’re predictable and essential.

2. Build a Sustainable Competitive Advantage (Your “Moat”)

A “moat” is what protects your profits from competitors. Buffett looks for one or more of these:

- Brand loyalty (e.g., See’s Candies—people pay more because they trust it)

- Low-cost operations (e.g., GEICO—efficient systems = lower prices + higher margins)

- Network effects (e.g., marketplaces where value grows with users)

- Regulatory or scale advantages (less common for small biz, but possible in local niches)

For small businesses, your moat might be deep local relationships, specialized expertise, or exceptional reliability.

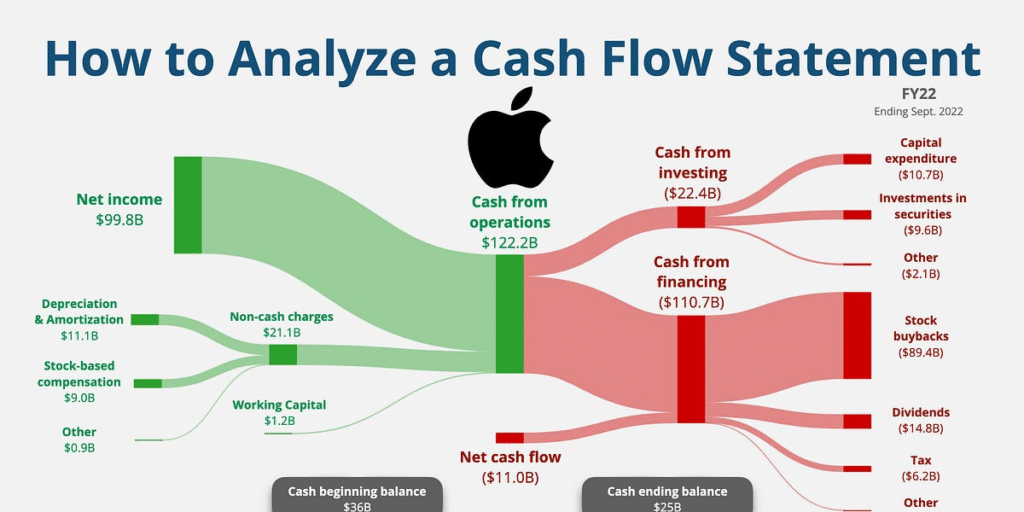

3. Prioritize Cash Flow Over Growth at All Costs

Buffett loves businesses that generate cash—not just revenue. Focus on:

- High gross margins (ideally 40%+)

- Low capital expenditure (you don’t need to reinvest heavily to grow)

- Predictable, recurring income (subscriptions, retainers, repeat customers)

Avoid “growth” that burns cash. As Buffett says:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

4. Run It Like You’ll Own It Forever

Buffett invests for decades—not quarters. Build your business with long-term integrity:

- Treat employees and customers fairly

- Avoid excessive debt

- Reinvest profits wisely (not on flashy offices or unnecessary hires)

- Say “no” to distractions that don’t serve your core mission

This mindset builds durability—the hallmark of businesses that thrive through recessions.

5. Be the Kind of Owner Buffett Trusts

Buffett bets on management as much as the business. Even as a solo founder, embody:

- Honesty: Transparent pricing, clear communication

- Frugality: Spend only where it matters (e.g., quality, service—not logos or parties)

- Passion: You genuinely care about your customers and craft

He once said: “I look for businesses I understand, with durable economic advantages, run by honest and able people.”

Final Thought

You don’t need to be public or massive to build a “Buffett business.” You need clarity, consistency, and character. Focus on serving real people, earning trust, and generating real profit—and you’ll build something worth owning for life.

FAQs

Q: Can a tech startup be a “Buffett business”?

A: Yes—if it has a clear model, strong margins, and a defensible moat (e.g., a niche B2B SaaS with sticky customers). Buffett now owns Apple because it acts like a consumer brand with recurring revenue—not just a tech company.

Q: Does Buffett only buy mature businesses?

A: He prefers proven models, but the principles apply at any stage. Build your early business with these values, and you’ll create something that scales with integrity.

Q: What’s the #1 mistake Buffett-style builders avoid?

A: Chasing trends over timeless needs. People will always need clean water, reliable services, trusted advice, and quality goods—build around those.