5 Proven Steps to Establish Credibility in 90 Days

If you’re launching a startup or scaling your small business, strong business credit can be your secret weapon. It unlocks loans, better vendor terms, and higher credit limits—all while protecting your personal finances. The best part? You don’t need years to build it. With the right approach, you can establish credible business credit in as little as 60–90 days.

Here’s how to build business credit fast—without shortcuts that backfire.

1. Formalize Your Business Structure Immediately

Start with a legal entity that separates you from your business—like an LLC or corporation. Sole proprietorships can’t build true business credit because they’re legally tied to your SSN. Once formed, obtain an Employer Identification Number (EIN) from the IRS (free at irs.gov). This EIN becomes your business’s financial ID.

2. Get a D-U-N-S® Number from Dun & Bradstreet

Dun & Bradstreet (D&B) is the most widely used business credit bureau. Request a free D-U-N-S Number—it typically takes 24–72 hours. This number links your business to its credit profile and is required by many lenders and suppliers.

💡 Pro Tip: Ensure your business name, address, and phone number (NAP) are consistent everywhere—especially on your website and Google Business Profile.

3. Open 3–5 “Net 30” Vendor Accounts That Report to Credit Bureaus

These are starter credit accounts where you buy supplies now and pay in 30 days. Crucially, choose vendors that report payment activity to D&B, Experian, or Equifax Business. Top fast-reporting options:

- Uline (packaging supplies)

- Grainger (industrial & safety gear)

- Crown Office Supplies (office essentials)

- Summa Office Supplies

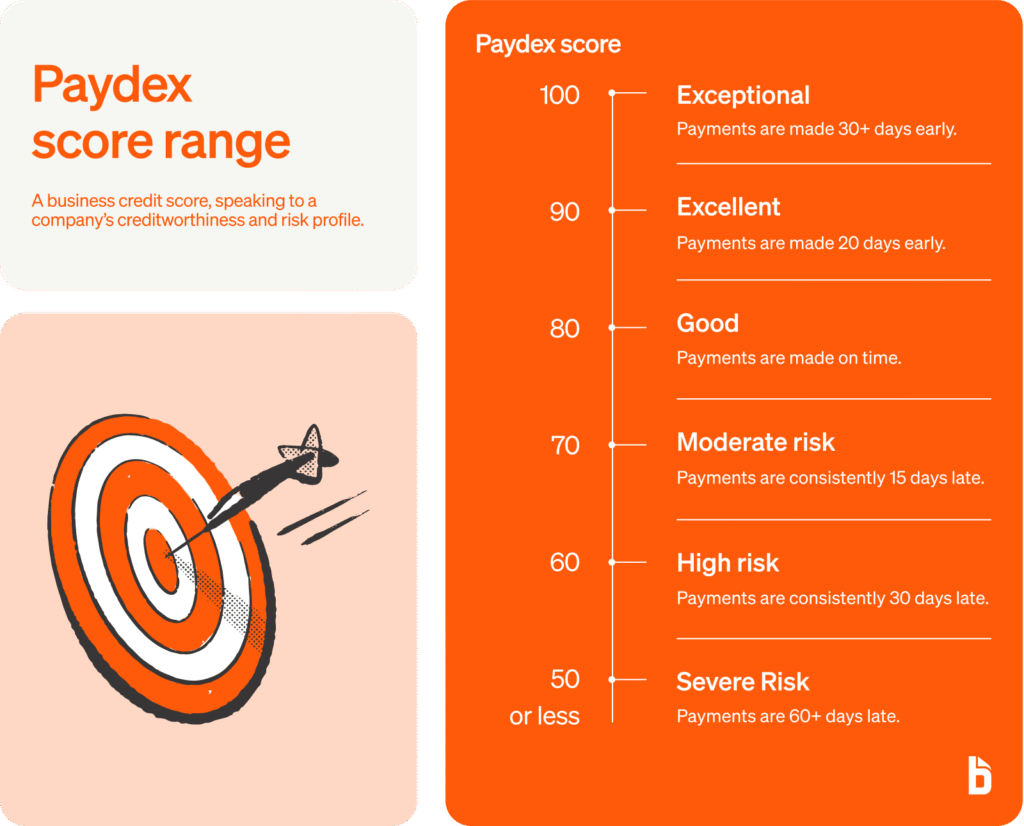

Apply using your EIN—never your SSN. Make small purchases and pay early (e.g., in 10–15 days) to boost your PAYDEX score (D&B’s business credit score).

4. Get a Business Credit Card That Reports to Bureaus

Apply for a business credit card that reports to at least one business bureau. Even if you have fair personal credit, secured cards (like Brex or Divvy) or cards from your business bank may approve you. Use it for recurring expenses (like software subscriptions) and pay the balance in full before the statement date to keep utilization low.

5. Monitor, Verify, and Scale

Check your business credit reports monthly:

- Dun & Bradstreet: businesscredit.dnb.com

- Experian Business: experian.com/business

- Equifax Business: equifax.com/business

Dispute inaccuracies immediately. Once you have 3+ tradelines reporting on time for 60+ days, you’ll qualify for better financing—like SBA loans or unsecured business lines of credit.

FAQs

Q: Can I build business credit in 30 days?

A: You can start in 30 days, but most lenders want 2–3 months of payment history. Aim for 60–90 days for fundable credit.

Q: Do I need revenue or a business bank account to begin?

A: Not always—but having both increases approval odds. Open a business bank account first to show legitimacy.

Q: Will my personal credit still be checked?

A: Initially, yes—especially for new businesses. But after 2–3 reported tradelines, many vendors and lenders rely solely on your business credit.